"We don't just register your Section 8 Company (NGO), we guide you like a friend"

This is what we provide in the package:

Contact Your Expert Now

Consult With an Expert | Quick Process | 100% Data Privacy

Our charges for the full package are INR. 16,788 Limited Period Offer + Govt Fees as per the state

Don’t choose us without reading what our valuable clients have to say about us

Few brands that our creative team has created for our valuable clients

We can help you choose a name for your company and create a great brand for you but that’s a separate service chargeable separately.

What is an NGO and how to apply for the registration of an NGO under Section 8 of Companies Act, 2013, as a section 8 company, in India online.

NGO (Non-Government Organisation) is an organization that works for non-profit/ charitable purposes like promotion of commerce, art, science, religion, education, donation, protection of the environment, social welfare, sports, or any other object of public utility.

If an NGO is formed as a company under Section 8 of Companies Act, 2013, as a section 8 company, the profits/ surplus of it can’t be provided to the shareholders as dividends but needs to used for the objects of the NGO for which it was registered.

Procedure for the incorporation of an NGO registered under Section 8 of Companies Act, 2013, as a section 8 company/ documents required for NGO registration/ How to apply for NGO registration/ NGO registration kaise kare

Step 1 – Obtain a DSC of the first Directors of the NGO to be registered as a Section 8 Company.

Step 2 – Application for the allotment of DIN for the first Directors of the NGO.

Step 3 – Apply for the Section 8 company name.

Step 4 – After approval, apply for a license for the NGO (Section 8 Company).

Documents required for application of the license allotment of the NGO (INC-12):

- Draft MOA as per Form INC-13

- Draft AOA

- Declaration as per Form INC-14 (Declaration from Practicing Chartered Accountant)

- Declaration as per Form INC-15 (Declaration from each person making application )

- Estimated Income & Expenditure for the next 3 years.

Step 5 – Once the form is approved, a license under section 8 will be issued in Form INC-16 for the NGO.

Step 6 – After obtaining the license, a form (SPICE Form 32) needs to filed with the ROC for registration along with the following attachments:

- An affidavit from all the first directors – INC-9

- Declaration of deposits

- KYC of all the Directors

- Form DIR-2 with its attachments i.e PAN Card and address proof of the directors

- Consent letter of all the directors

- Interest in other entities of the directors

- Utility bill as a proof of Office address

- NOC in case the premises are leased/rented

- Draft MOA and AOA

After the satisfaction of ROC a Certificate of Incorporation along with a unique Company Identification Number (CIN) is issued.

If you wish to register an NGO as a section 8 company, you need to take care of the following points:

An NGO cannot have a Profit Motive for its shareholders

Benefits of an NGO registration as Section 8 Company:

- Exemption from Stamp Duty.

- Tax deductions to the donors of the Company u/s. 80G of the Income Tax Act if the NGO has received an 80G registration.

- NGOs as Section 8 Companies can be formed even without share capital, and the necessary funds for carrying the business are raised in the form of donations, subscriptions from members and the general public.

- NGOs as a Section 8 Company are not required to add the suffix Limited or Private Limited at the end of their name.

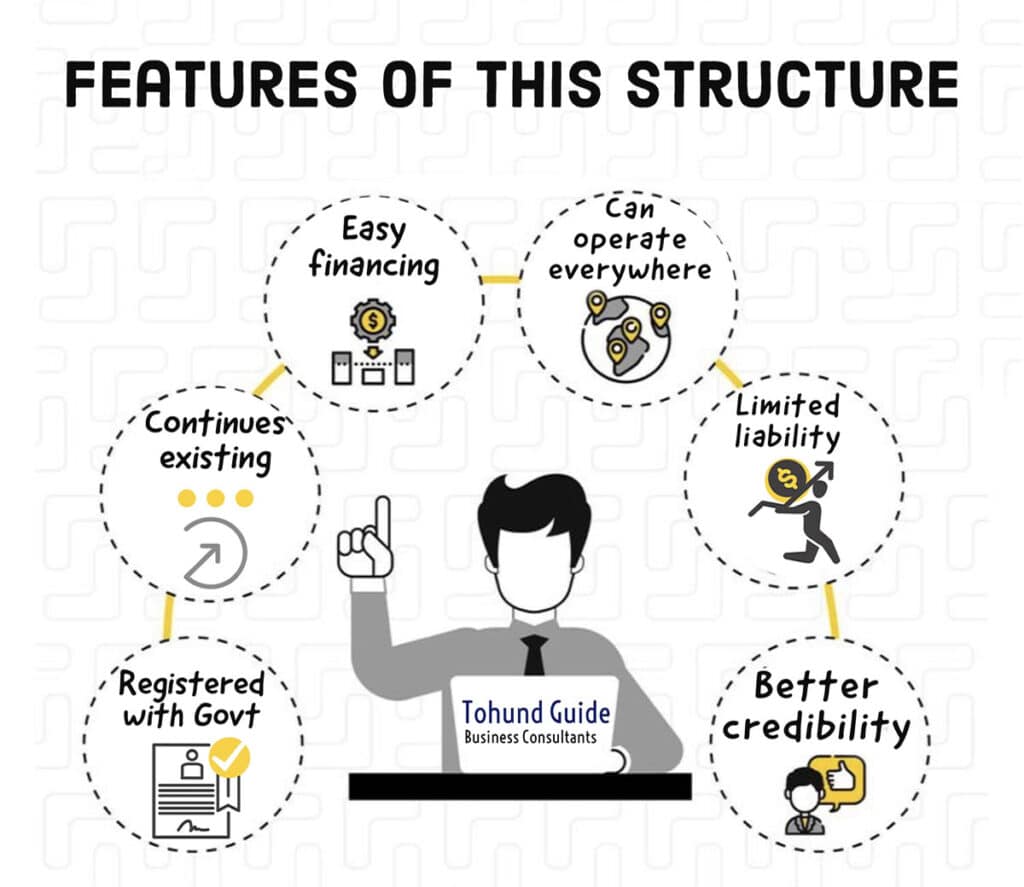

An NGO registered as a Section 8 Company has more credibility as compared to any other Non-profit organization structure like Trust or Society

Examples of some famous NGOs in India:

Documents Required

Aadhaar Card

Pan Card

Voter ID

Bank Statement

Electricity Bill

NOC

Passport Size Photo

Business Description

How do NGOs get funding?

Donations

In case an NGO is working for a good cause and appeals public at large it can receive donations for the purpose from the public and if the NGO holds 80G or 35AC Registration then it can issue Tax Exempted Receipts through which the donor gets tax exemptions on every donation made and the chances of receiving Donations by the NGO are enhanced.

Funding from Government

If a Section 8 company or any other form of NGO has a project that they want to carry out, they can submit the same with Government and will get the grant if Government approves that.

Corporate Social Responsibility

There is a requirement for certain companies that they should spend some amount of their money for the degradation and benefit of society. If the credentials of an NGO are good they can get funding from these companies as well. For a new NGO Section 8 Company adds to the credentials.

Foreign Funding

In case any foreign NGO or organization wants to carry out an activity in India or an Indian NGO especially a Section 8 Company approaches a foreign organization for funding then if the NGO holds FCRA it can get funds from the foreign organization.

Why Choose Us?

Cost Effective

Our goal is for our processes to be seamlessly integrated into our customers

Legal Advice

We will give you legal information and make this entire process seamless.

100% Satisfaction

We ensure that you stay 100% satisfied with our offered services

Secure & Safe

All your private information is secure & safe with us

We are very happy for our client’s reviews

Rohit Aggarwal

Anurag Kashyap